The Reality of Teeth Whitening Coverage

Teeth whitening is a popular cosmetic procedure, promising a brighter, more confident smile. However, one of the most common questions patients ask is whether their dental insurance covers the cost. The short answer is usually no, but understanding the nuances of dental insurance policies is crucial. Many insurance plans consider teeth whitening an elective, cosmetic procedure, and therefore, do not provide coverage. There are specific situations where some coverage might exist, although this is the exception rather than the rule. This article will delve into the specifics of teeth whitening coverage, providing insights into why it is typically not covered and exploring alternative options for achieving that dazzling smile.

Why Teeth Whitening is Often Not Covered

The primary reason teeth whitening is often not covered by insurance boils down to the distinction between cosmetic and necessary dental procedures. Insurance companies are designed to cover procedures that address health issues and are deemed medically necessary. Cosmetic procedures, like teeth whitening, are performed to enhance appearance rather than treat a disease or improve oral health. This fundamental difference dictates how insurance companies categorize and reimburse for dental treatments. Understanding this differentiation is essential for managing expectations regarding coverage and financial planning for teeth whitening.

Cosmetic vs. Necessary Procedures

Necessary dental procedures address health concerns like cavities, gum disease, or infections, and are vital for maintaining oral health. These procedures are considered essential for overall well-being and are typically covered by dental insurance. Cosmetic procedures, on the other hand, are elective and improve the appearance of the teeth or smile. While they can boost confidence, they are not essential for oral health. This distinction is the core reason for the coverage disparity.

Insurance Company Policies

Insurance companies have policies that explicitly exclude cosmetic procedures from coverage. These policies vary, but they consistently emphasize coverage for treatments that address medical needs. Some plans may offer a limited allowance for cosmetic procedures, but teeth whitening is rarely included. Always review your specific plan details or contact your insurance provider to clarify their policy regarding teeth whitening. Carefully read the policy to avoid any surprise expenses.

The Role of Your Dental Plan

The type of dental plan you have significantly impacts the likelihood of teeth whitening coverage. Different plans have varying levels of coverage, with some being more comprehensive than others. Understanding the specifics of your plan can help you anticipate what might be covered and what you will pay out-of-pocket. Different plans include PPO, HMO, and discount plans. Each has its own set of guidelines and restrictions, influencing what procedures are covered.

Types of Dental Insurance Plans

Preferred Provider Organization (PPO) plans often provide more flexibility in choosing dentists and may offer some coverage for cosmetic procedures, although whitening is unlikely. Health Maintenance Organization (HMO) plans generally have lower premiums but may have more restrictions, often requiring you to use dentists within their network. Discount dental plans are not insurance but offer reduced fees for dental services. These may be a more affordable option for teeth whitening. Reviewing your plan’s details and comparing available options is crucial.

Factors Influencing Coverage Decisions

Several factors influence the coverage decisions of insurance companies. The primary factor is the medical necessity of the procedure. If teeth whitening is deemed purely cosmetic, it is unlikely to be covered. The specific terms of your insurance plan also play a significant role. Plan exclusions and limitations often specify which procedures are not covered. The dental provider’s coding and documentation may influence coverage. Clear documentation supporting a medical need may improve your chances, although this is rare for whitening. Lastly, some plans have waiting periods that must be satisfied before certain procedures are eligible for coverage.

Top 5 Facts About Teeth Whitening Coverage

Fact 1 The General Rule of Thumb

Generally, dental insurance does not cover teeth whitening because it is considered a cosmetic procedure. Insurance providers focus on treatments that address oral health issues. There are some exceptions, but you can’t count on that. Always verify the details of your plan and speak with your insurance company before undergoing any procedure.

Fact 2 Limitations and Exclusions

Most dental insurance plans have specific limitations and exclusions regarding cosmetic procedures. These exclusions explicitly state that teeth whitening is not covered. Review your insurance policy carefully. The fine print can clarify what is and isn’t covered. Understanding these exclusions is crucial for financial planning.

Fact 3 Medical Necessity Considerations

In rare cases, teeth whitening might be considered if there’s a medical reason, like discoloration due to trauma or medication. However, this is usually not the case, and you will need to provide extensive documentation and approval from your insurance provider. Be sure to explore all avenues, although you shouldn’t count on this coverage.

Fact 4 The Importance of Pre-Approval

If you’re considering teeth whitening and believe it might be covered, always get pre-approval from your insurance company. This process involves submitting a treatment plan to your insurer to get a decision before starting. This ensures there are no surprises regarding your out-of-pocket costs. Pre-approval helps to avoid financial shocks.

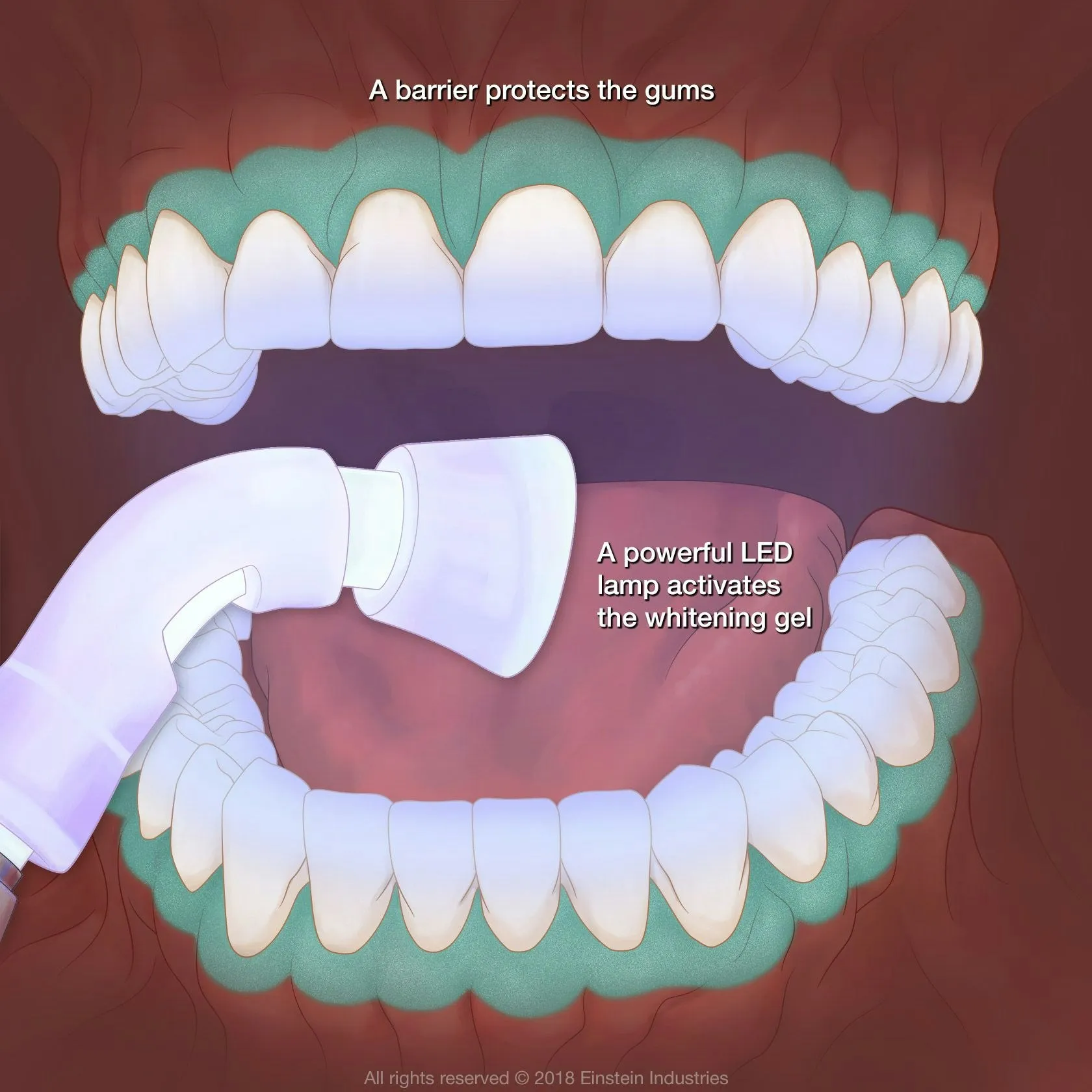

Fact 5 Alternative Options for Whitening

If insurance doesn’t cover teeth whitening, you have several alternative options. These include in-office whitening, take-home whitening kits from your dentist, or over-the-counter products like whitening strips or toothpaste. Understanding your options can help you achieve a brighter smile while managing your budget effectively. Consider what option works best for your needs.

What To Do If Whitening is Not Covered

If your insurance doesn’t cover teeth whitening, there are steps you can take to achieve your goals. These steps range from exploring payment options to discussing affordable alternatives. It is essential to maintain a consistent dental hygiene routine.

Explore Payment Options

Dental offices often offer payment plans or financing options to make teeth whitening more accessible. These plans allow you to spread the cost over time. You can also consider using a health savings account (HSA) or flexible spending account (FSA) to pay for the procedure. Comparing costs across dental practices can also help find the most affordable option. Make sure to explore all available payment methods to choose the one that works best for you.

Discuss Affordable Alternatives

Talk to your dentist about alternative whitening methods. They may suggest take-home whitening kits, which are usually more affordable than in-office procedures. Over-the-counter products, such as whitening strips or toothpaste, can also provide noticeable results at a lower cost. Your dentist can guide you toward the most effective and affordable options for your specific needs. Remember, the best solution depends on your budget.

Maintain a Consistent Dental Hygiene Routine

Regardless of whether you choose to whiten your teeth, maintaining a solid dental hygiene routine is crucial. Brush your teeth at least twice a day, and floss daily to remove plaque and food particles. Regular dental check-ups and professional cleanings can also help keep your teeth bright and healthy. A consistent hygiene routine helps maximize the results of any whitening treatments.